19+ paycheck calculator nd

North Dakota levies a progressive state income tax with five brackets based on income level. North Dakota Paycheck Calculator.

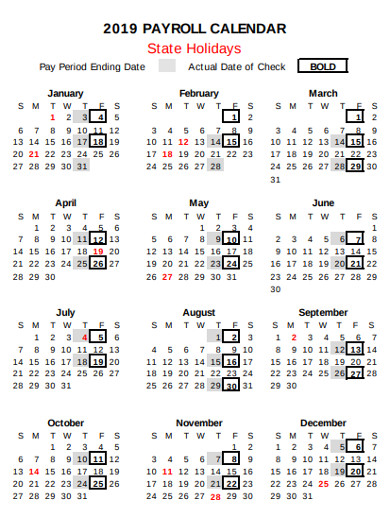

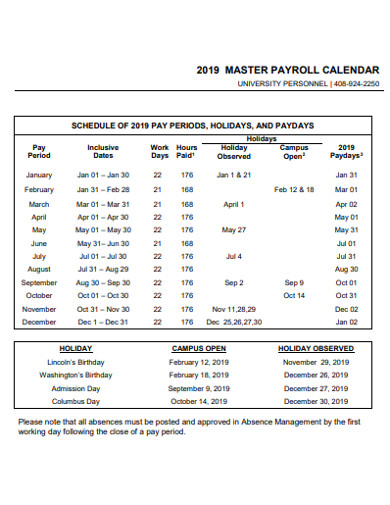

Payroll Calendar 19 Examples Format Pdf Examples

So the tax year 2022 will start from July 01 2021 to June 30 2022.

. How to calculate annual income. North Dakota Hourly Paycheck Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take home pay is calculated based on hourly pay rates that you enter along with the pertinent Federal State and local W-4.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Area of kite calculator. North Dakota Hourly Paycheck and Payroll Calculator.

Payroll pay salary pay check. COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit. It is not a substitute for the.

Important Note on Calculator. The state income tax rate in North Dakota is progressive and ranges from 11 to 29 while federal income tax rates range from 10 to 37 depending on your income. Back to Payroll Calculator Menu 2013 North Dakota Paycheck Calculator - North Dakota Payroll Calculators - Use as often as you need its free.

Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance. For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year. North Dakota Hourly Payroll Calculator - ND Paycheck Calculator.

Need help calculating paychecks. The North Dakota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. The state is notable for its low income tax rates which range.

The 2022 wage base is 147000. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Supports hourly salary income and multiple pay.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Dakota residents only. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. Simpson diversity index calculator.

Calculate your North Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Dakota. This free easy to use payroll calculator will calculate your take home pay. Overview of North Dakota Taxes.

Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Calculating your North Dakota state income tax is similar to the steps we listed on our Federal paycheck. For example if an employee earns 1500.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Payroll Tax Paycheck Calculator Youtube

Payroll Calendar 19 Examples Format Pdf Examples

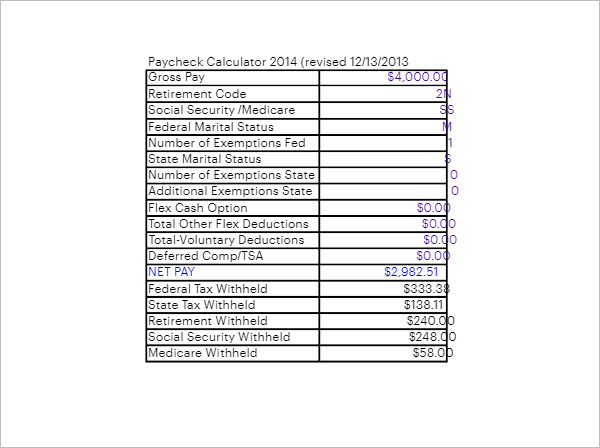

12 Salary Paycheck Calculator Templates Free Pdf Doc Excel Formats

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

How Much Can You Earn By Working On Campus At Ubc As An International Student And Is It Enough To Fund Your Living Costs Quora

Paycheck Calculator And Salary Calculator Employment Laws Com

Coronavirus Advice Stallardkane Associates

Us Paycheck Calculator Queryaide

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How Good Are You At Gcse Maths Take Our Quiz Gcses The Guardian

Yaymail Woocommerce Email Customizer Yaycommerce

Paycheck Calculator Us Apps On Google Play

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Strengthening The Governance Of The Skills System Oecd Skills Strategy Latvia Assessment And Recommendations Oecd Ilibrary

Education Budgeting In Bangladesh Nepal And Sri Lanka